1. What is FFD4?

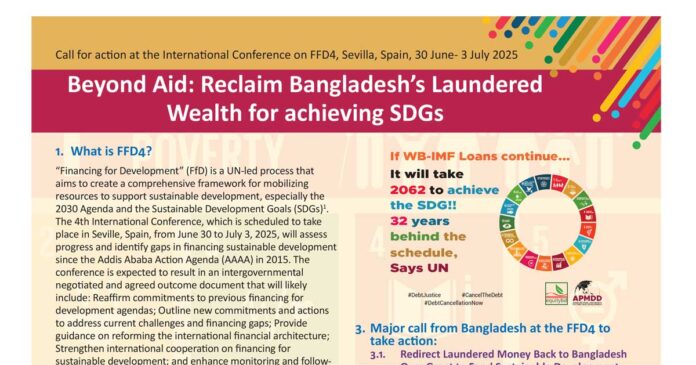

“Financing for Development” (FfD) is a UN-led process that aims to create a comprehensive framework for mobilizing resources to support sustainable development, especially the 2030 Agenda and the Sustainable Development Goals (SDGs)1. The 4th International Conference, which is scheduled to take place in Seville, Spain, from June 30 to July 3, 2025, will assess progress and identify gaps in financing sustainable development since the Addis Ababa Action Agenda (AAAA) in 2015. The conference is expected to result in an intergovernmental negotiated and agreed outcome document that will likely include: Reaffirm commitments to previous financing for development agendas; Outline new commitments and actions to address current challenges and financing gaps; Provide guidance on reforming the international financial architecture; Strengthen international cooperation on financing for sustainable development; and enhance monitoring and followup mechanisms to track progress.

2. Why is FFD4 important for Bangladesh’s SDGs?

FFD4 marks a significant turning point for Bangladesh’s achievement of the Sustainable Development Goals (SDGs). FFD4 seeks to reform global finance systems, including domestic resource mobilization (DRM), debt policy, and climate finance— areas critical to Bangladesh’s next phase of progress2. For a nation experiencing dwindling grant flows and mounting debt, FFD4’s focus on strengthening tax systems and fair debt restructuring provides timely momentum to unlock funds needed to scale up health, education, poverty reduction, and clean energy efforts. Outcomes from FFD4 could provide the blueprint for Bangladesh to mobilize diverse financial sources and accelerate its journey toward achieving the SDGs.

Bangladesh is transitioning from a Least Developed Country (LDC) to a developing country status, a milestone expected to be finalized by 2026. The country has also improved its global SDG ranking, moving from 120th to 101st in seven years3. However, the recent analysis of different significant sectors shows a gloomy look at the current SDG progress, e.g., Bangladesh is the 7th most vulnerable country in the world4. 56% of the total population (90 million) live in areas highly exposed to climate issues5. 1.78 million are engaged in child labour. The national poverty rate is 18.7%6 and the country is witnessing a concerning rise in poverty.

1 https://financing.desa.un.org/about-ffd4

2 www.unep.org/events/conference/fourth-international-conference-financingdevelopment-

ffd4

3 Sustainable Development Report, 2023 by the Sustainable Development

Solutions Network (SDSN) and the Bertelsmann Stiftung.

4 Global Climate Risk Index (CRI) 2021

5 National SDG Report (VNR) 2025, by Citizen’s Platform for SDGs, Bangladesh.

6 Bangladesh Bureau of Statistics (BBS).

The gender ratio and payment in the workspace are not equal; underrepresentation in all spaces, gender-based violence is on the rise, child marriage rate remains alarmingly high at 51.40%, etc.

3. Major call from Bangladesh at the FFD4 to take action:

3.1. Redirect Laundered Money Back to Bangladesh Over Grant to Fund Sustainable Development

Over the past 15 years, individuals from various sectors, including politicians, businesspeople, bureaucrats, and police officials, have reportedly laundered over $100 billion abroad. This figure is likely underestimated, but even if it’s close to the actual amount, the implications are staggering. To put this into context, $100 billion is nearly equivalent to Bangladesh’s national budget for the next two years. It also matches the

country’s total external debt as reported by Bangladesh Bank. One could argue that if this money had not been laundered, it could cover nearly all of Bangladesh’s foreign debt across both public and private sectors. Moreover, if repatriated, these funds could ease the strain on Bangladesh’s foreign exchange reserves, helping to curb inflation7.

On the other hand, aid support is declining. The termination of the USAID funding was not an isolated event. On 25 February 2025, the UK Prime Minister announced that the government would “fully fund our increased investment in defence” by reducing aid spending from 0.5% of gross national income (GNI) to 0.3% in 20278. Dutch development

aid will decline from 0.62% of its GNI to 0.44%. The Dutch Minister for Foreign Trade and Development announced a funding cut of € 2.4 billion from 2027 to give precedence to

Dutch interests, i.e., promoting trade, enhancing security and reducing migration9. Likewise, the Governments of Germany, Switzerland, and Belgium have also announced aid cuts for 202510. So, rich countries will not be able to provide much aid in reality. Therefore, FFD4 should take pragmatic steps to stop the illicit financing and redirect the laundered money back to the countries of origin, like Bangladesh.

7.https://www.thedailystar.net/opinion/views/news/what-bangladesh-can-doget-

back-laundered-wealth-3717016

8. https://commonslibrary.parliament.uk/uk-to-reduce-aid-to-0-3-of-grossnational-

income-from-2027/

9. http://bit.ly/43iIugf

10 Singh, S_Humanitarian Reset – A Decolonial Perspective

3.2. Cancel the Illegitimate Debt to Bangladesh

Bangladesh’s external debt soared to $103 billion by the end of December 2024, doubling from $51 billion in fiscal year (FY) 2016–1711. In fiscal year 2023-24, Bangladesh’s per capita external debt reached $605, a 135% increase compared to fiscal year 2015-16. While the country continues to struggle with meeting basic needs in health, education, and other essential services, the National Budget for FY 2025–2026 allocates 15.4% of total expenditure to debt servicing. To finance this, the government plans to raise 12.2% of the budget through foreign borrowing.

The debt doubling reflects a period of aggressive borrowing, largely to fund infrastructure and energy projects, which has had less impact on people’s lives, but they are now paying the price. The illegitimate debt to Bangladesh should be cancelled.

The debt doubling reflects a period of aggressive borrowing, largely to fund infrastructure and energy projects, which has had less impact on people’s lives, but they are now paying the price. The illegitimate debt to Bangladesh should be cancelled.

Bangladesh ranks 7th on the Global Climate Risk Index, reflecting its extreme vulnerability to climate change. According to the IPCC, the country could lose up to 30% of its food production capacity by 2050 due to rising temperatures, salinity, and erratic weather. Coastal regions are already facing a severe freshwater crisis, affecting both agriculture and daily life. Despite losing an estimated USD 12 billion annually to climate-related impacts, Bangladesh receives only around USD 600 million in climate finance, most of which comes in the form of foreign loans rather than grants. As Bangladesh has historically contributed little to global carbon emissions, it bears no responsibility for the climate crisis. Therefore,

climate-related loans should be cancelled.

3.3. Introduce Fare Taxation and Tax to GDP Ratio

In 2024, Bangladesh’s tax-to-GDP ratio was reported at 7.4%, the lowest in all countries of Asia, severely limiting the country’s ability to invest in essential public services such as

health, education, climate adaptation, poverty reduction, and women’s empowerment.

According to Centre for Policy Dialogue, Bangladesh loses an estimated BDT 60 billion annually due to tax evasion and avoidance, much of it linked to corporate tax evasion. This

figure, equivalent to about 0.1% of the country’s GDP, could otherwise increase annual allocations to the health sector by 15%, education sector by 6.5% and social security sector by 5%.

The National Board of Revenue (NBR) aims to raise the tax-to-GDP ratio to 10% by 2032 and 10.5% by FY 2035. The International Monetary Fund (IMF) has also pushed for an

increase of 0.6 percentage points in the current fiscal year12. However, rather than reforming tax systems or broadening the tax base fairly, the government has responded by lifting exemptions on some basic goods and services and doubling VAT, shifting the burden onto ordinary citizens. This regressive taxation strategy contradicts the principles of tax justice. Economists warn that for every 1% increase in indirect tax, the poverty rate rises by 0.42%.

4. Bangladesh’s demand at FFD4

4.1. Stop Illicit Financial Flows: FFD4 must adopt effective global measures to curb illicit financial flows and repatriate laundered money. Redirecting these funds to countries like Bangladesh to ensure financing for sustainable development.

4.2. Fulfil ODA Commitments: Global aid is shrinking, yet most high-income countries still fall short of their 0.7% GNI commitment for Official Development Assistance (ODA). Currently, only Denmark, Germany, Luxembourg, Norway, and Sweden meet or exceed this target. Other OECD countries must fulfil their promises.

4.3. Cancel Illegitimate Debts; Climate Finance as Grants: All illegitimate debts to Bangladesh should be cancelled. Climate finance must be provided as grants, not loans, to countries with minimal historical responsibility for emissions. No new loan should be approved without prior discussion and consent in Bangladesh’s national parliament.

4.4. Ensure DFQF Access Post-LDC Graduation: Bangladesh must be granted Duty-Free Quota-Free (DFQF) market access for at least 10 years after graduating from LDC status to ensure a smooth transition, protect its export base and workforce.

4.5. UN-Led Fair Tax Reform: IMF-imposed taxation reforms are often regressive and exacerbate poverty. Tax reforms in Bangladesh should instead be guided by a UN Global Tax Convention to ensure justice, equity, and accountability.

4.6. Fully Fund the Rohingya Humanitarian Response: The 2024 Rohingya Joint Response Plan (JRP) in Bangladesh faces a significant funding shortfall— only 64% funded as of February 18, 2025 (USD 545.4 million received out of USD 852.4 million). The Rohingya crisis is a global responsibility. The international community must ensure full and

sustained funding without shifting the burden onto host countries like Bangladesh.

11 www.thedailystar.net/business/news/external-debt-doubles-sevenyears-

3901161

12. https://www.thedailystar.net/business/news/nbr-targets-105-tax-gdp-ratiofy35-

amid-imf-push-3882681